Help! I’ve Been Elected Board Treasurer

So, you’ve found yourself in the role of board treasurer. Maybe you were nominated when you were on that beach vacation (the “gotcha” approach), maybe you had the word “finance” somewhere in your title and seemed like the logical fit (the “it’s only logical” angle), or maybe you’re one of those wonderful folks who always shoots up their hand to be treasurer. For many, the role of board treasurer may seem intimidating, but like many things that can cause apprehension, I’d argue this role is often misunderstood.

“By reframing and taking a more expansive view of what the role entails, I hope more new treasurers will enter the role with excitement instead of intimidation and ultimately, that more people will want to volunteer for this leadership opportunity.”

Mario Hernandez

I’ve found there are two main reasons people are hesitant to take on the role of treasurer: they lack confidence in their ability to do the role because they don’t have a clear idea of what it entails, or they feel overwhelmed by the lack of systems in place and are therefore worried something could go wrong…and that they’ll be the one responsible. However, the board treasurer is a critical leadership role for an organization. By reframing and taking a more expansive view of what the role entails, I hope more new treasurers will enter the role with excitement instead of intimidation and ultimately, that more people will want to volunteer for this leadership opportunity.

Defining the Role of Board Treasurer

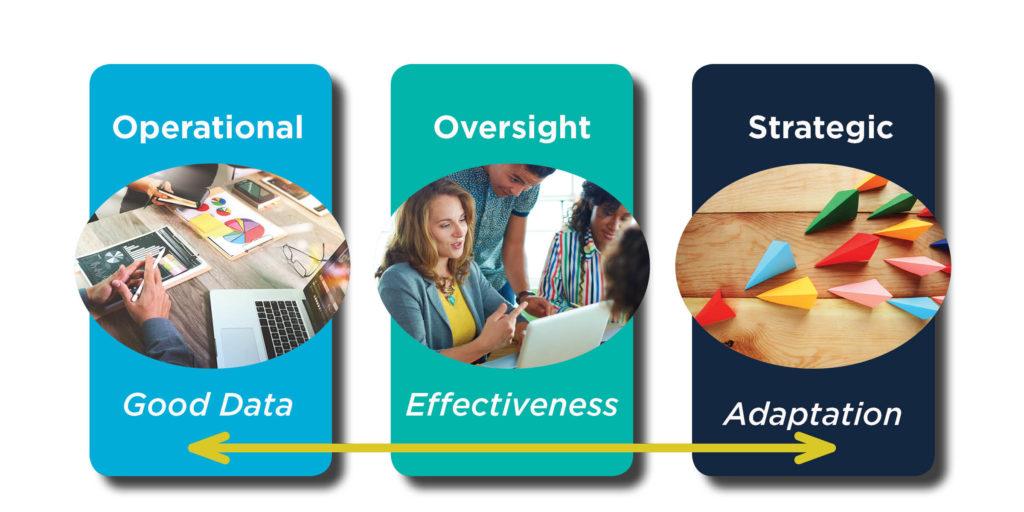

To overcome confusion about the role, nonprofits have the responsibility to write a clear job description for board treasurer. Whether you’re new to the role or the person recruiting and on-boarding a treasurer, there are essentially three big responsibilities to keep in mind:

- Operational: Treasurers are responsible for ensuring board members are seeing good, clear data to help inform decisions. This requires cooperation with staff to find a system for providing good financial information to the board and then communicating that data in a way the board can digest. For example, when I was a treasurer at the Immigrant Law Center of Minnesota, I was fortunate to work with their associate director, who was a good finance director. Staff was responsible for producing the financial reports, and I was responsible for guiding what would be most useful on those reports and framing the board conversation from there.

- Oversight: It’s tempting to list out all the legal requirements and due diligence here, but I’d argue the treasurer’s oversight role is about putting good systems in place: what is the process for selecting an auditor or establishing a budget review process? Who creates and leads the timeline for filing 990s? How does a finance committee fit in? Treasurers should help build oversight guardrails rather than simply fear going outside of them.

- Strategic: This piece is too often overlooked but is what differentiates a treasurer who is an effective financial manager from a good financial leader. A successful board treasurer does not need to be an accountant or bookkeeper, but they do need have an interest in and willingness to learn accounting skills like nonprofit budgeting and cash flow projections so they can use these tools for decision making. They use the good data and technical knowledge to understand what’s going on “in the weeds,” and then use that information to lead strategically.

I was recently working with two organizations who were talking through a merger process, which provide a good example of how these responsibilities can work together. Part of the reason we were at a merger talk was because both organizations were financially fragile and saw a merger as a strategy for greater financial sustainability. Yet they went through a period when they were stuck in wading through deficit details.

However, the board treasurer went back and reviewed what assets they had: One organization had a reserve. There was a funder who had asked them to consider a merger that they could go back to for possible financial support, once they had a clearer understanding of transition costs. The treasurer helped them go from a place of seeing no way to finding options to make the merger financing work; they used good data (operational) to find different solutions (strategic).

A treasurer can play a powerful role in helping unearth those financial options. This role entails more than reporting on the budget and making sure there is an audit process (which are also important!): it calls for creativity, communication, and collaboration. These adaptive qualities can be overlooked but are required of a board treasurer to facilitate strategic financial leadership. The role should clarify the need for both adaptive and technical skillsets.

Setting a Board Treasurer Up for Success

It’s up to an executive director and board chair to equip a treasurer for operational, oversight, and strategic success. They are responsible for both supporting the current board treasurer and helping develop new leaders for the role. Know that it takes time for a board treasurer to get good at their role; the size of organization, number of programs, business model, board member’s finance experience, and frequency of board meetings all impact the treasurer’s learning curve. The payoff of clarifying the role and supporting the board treasurer as they go: more volunteering and less persuading for the role!

If you’re a new treasurer or an executive director, check out Propel’s upcoming trainings; we have a training on July 24: Treasurer/Finance Committee: Right People, Right Roles. Also, re-visit Kate Barr’s blog on What Makes a Great Board Treasurer.