Propel Nonprofits Surpasses $300 Million Milestone in Loans to Nonprofits

Propel Nonprofits, a leading force in providing financial expertise and resources to nonprofit organizations, is thrilled to announce a significant milestone: the disbursement of over $300 million in loans to empower and strengthen the vital work of nonprofits in Minnesota.

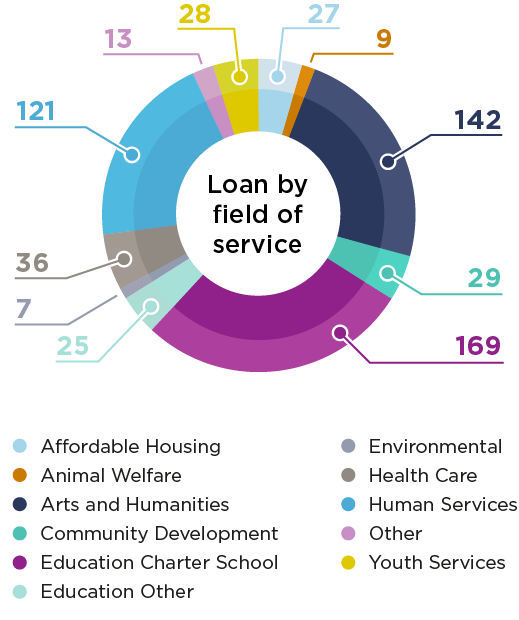

The $300 million mark represents a collective investment across the nonprofit sector, including a range of diverse nonprofits in healthcare, education, environmental conservation, social justice, and more. Propel is proud to be a trusted partner to so many nonprofit organizations and is one of 40 Community Development Financial Institutions (CDFIs) in the state of Minnesota. What makes Propel unique is that it is the only CDFI that lends exclusively to nonprofit organizations. The lending team recognizes the unique challenges faced by each organization and tailors financial solutions to ensure their long-term success.

“Reaching the $300 million milestone in loans is a testament to the incredible impact that nonprofits have on our communities,” said Hibo Abdi, Loan Fund Director of Propel Nonprofits. “We often say we are champions of nonprofits, but we are more than that. We are beneficiaries of the work they do and the communities they create. Our mission is to see their missions play out. I am so proud to be a part of a team of people that gets to support and ensure their long-term success.”

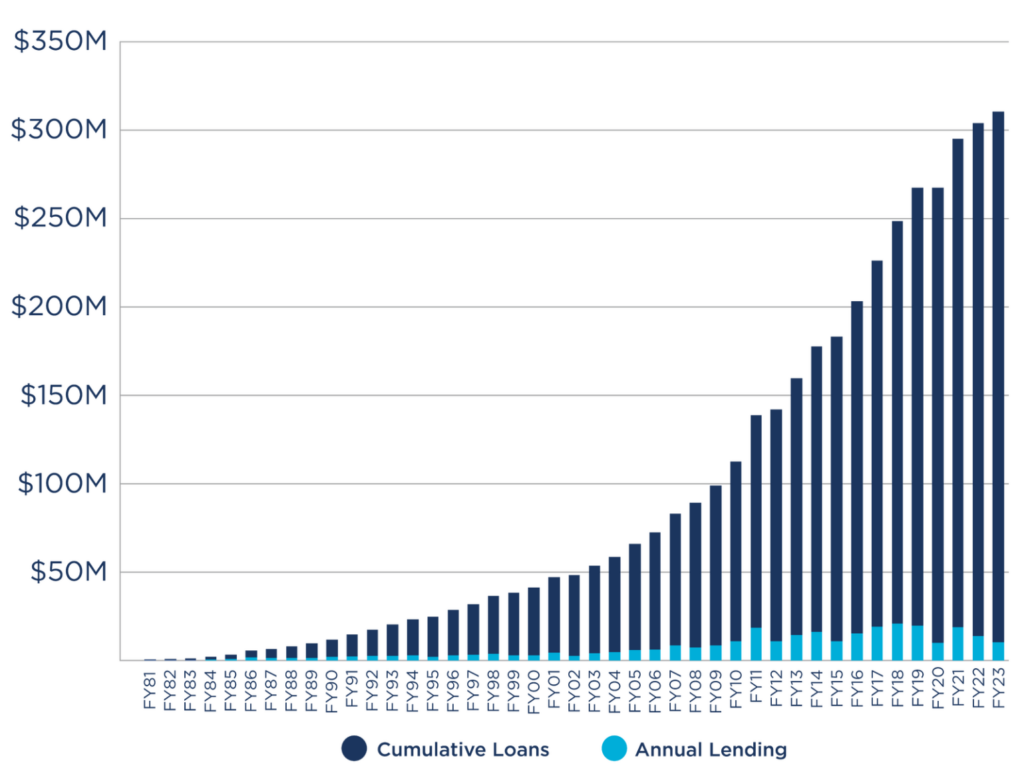

Cumulative Loans Made by Propel

Through its diverse portfolio of services, Propel Nonprofits is dedicated to fostering the growth and sustainability of nonprofit organizations by providing essential financial tools, resources, and customized support. The organization collaborates closely with nonprofit partners to offer flexible and innovative financial solutions, including loans for capital projects, cash flow management, and strategic initiatives. By addressing the unique financial needs of each organization, Propel Nonprofits has played a pivotal role in transforming challenges into opportunities for growth and impact.

Scott Marquardt, President of the Southwest Initiative Foundation, and Propel Nonprofits Board Member and Loan Committee Chair said, “Propel’s dedication to creating responsive products for nonprofits is what makes this moment so thrilling. The impact of these dollars flowing into Minnesota communities cannot be overstated. As chair of the loan committee at Propel, I get to witness the dedication of volunteer loan committee members, investors, funders, and the staff at Propel who make this work possible.”

The success of Propel Nonprofits in reaching this milestone is a result of the collective efforts of its dedicated team, supportive partners, volunteer loan committee members, and countless nonprofits that have embraced its mission. The lending work of Propel started in 1981 with the formation of Community Loan Technologies and was carried forward by the Nonprofits Assistance Fund (NAF). In 2017, NAF merged with MAP for Nonprofits, creating Propel Nonprofits. Merging allowed the organization to pair lending activities with wraparound services focused on strategy, finance, and governance. Speaking to the growing impact of the fund, over $120,000,000 has been loaned since 2017.

“I remember every loan I’ve made in the last six years at Propel,” Propel Portfolio Director, Sarah Bauer Jackson, said. “I feel an urgency in my role to ensure our capital is meeting our mission, and I am proud of the way we have done our work. In addition to the capital we’ve moved into the community, we’ve leveraged an additional $104,000,000 since 2017 to increase our impact and ensure nonprofits thrive.”

“I can say with full confidence that Minnesota is a better place because of Propel,” said Andrew Swammi, Senior Vice President at American National Bank. “We’ve worked alongside them for more than 20 years and their partnerships with nonprofits have improved the lives of countless people in need—the kind of help that will echo for generations. For many nonprofits, they are the fuel that the creates sustained, positive, transformational change. It’s in ANB’s DNA to serve others and support the community, and we know that when we partner Propel, we can all expect to make significant strides forward.”

Propel’s Loan Fund by the Numbers:

We’ve always focused our efforts on critical and emerging fields of service and moving capital to those who have been historically excluded from accessing funds. We’re already imagining, as partners to nonprofits, what we can do with the next $300M. Given our deep connections to the nonprofit sector, our enduring focus has been on creating responsive products.

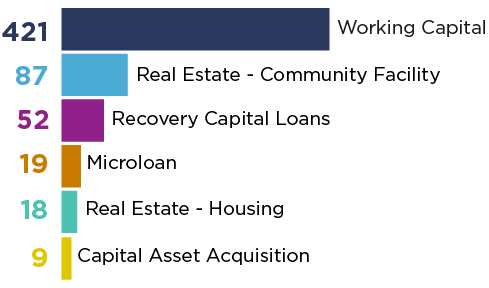

Almost 70% of Propel’s loans are working capital loans. Working capital supports the operational functions of the organization. Access to cash is essential for nonprofits for any business to their work. Propel is proud to partner with nonprofits that need working capital for a variety of reasons, whether they are immediate or planned.

- 606 total loans originated since January 1, 2017

- 86% of the dollars Propel lends benefits low-income community members

- 69% of the dollars Propel lends benefits nonprofits led by women

- 42% of the dollars Propel lends benefits organizations led by Black people, Indigenous people, or People of Color

- The lending team has not only been able to surpass $300 Million in loans made to nonprofits, but since 2017 they’ve also leveraged $104,275,405 of matching funds into the community.

Loans by field of service (2017 – 2023)

Loans by type (2017 – 2023)

What our clients have to say

Parenting with Grace

The mission of Parenting with Grace, Inc (PWG) is to provide families with a safe environment with education to raise resilient children.

Parenting with Grace, Inc. (PWG) provides supervised and monitored parenting time services to facilitate safe interactions between children and noncustodial family members. PWG, a first-time loan client of Propel, requested $25,000, which was approved as a microloan. The loan was for purchasing essential supplies and making leasehold improvements, specifically for Sheetrock, 2x4s, doors, paint, ADA bathroom enhancements, flooring, contractor fees, and furnishing three visitation rooms.

“Without the loan from Propel we would not have been able to remodel our building as quickly as we did. Once our remodel was done, we were able to open our doors and start fulfilling our mission of keeping kids emotionally and physically safe. The team at Propel was so wonderful to work with. They made everything a simple process, which reduced the stress of navigating a remodel and opening a business at the same time.” – Chrystal Fischer, Founder/Executive Director

Turning Point, Inc.

The mission of Turning Point is to meet the needs of our community, beginning with chemical health.

Turning Point accessed a working capital line of credit to manage cash flow with a new Hennepin County contract for opioid treatment and several state grants and contracts.

“Words cannot express the impact of the Propel loan that stabilized our organization. Turning Point was on the verge of closing after almost 50 years. Propel stepped in and revived Turning Point and we are eternally grateful. We can now continue our mission to save the lives in our community. Thank you for your partnership and your support.” – Lori Wilson, CEO, Turning Point Inc.

Family Tree Clinic

Family Tree Clinic’s mission is to cultivate a healthy community through comprehensive sexual health care and education.

Their most recent loan is a working capital line of credit to manage state contracts for sexual, reproductive, and trans-inclusive health care, delivered in a trauma-informed manner.

From Family Tree Clinic

Propel Nonprofits has been such a fantastic community partner to Family Tree Clinic. Our partnership isn’t just about receiving a loan; it’s about securing the lifeline that fuels our mission of cultivating a healthy community through comprehensive sexual health care and education.

In the delicate ecosystem of nonprofit funding, where program expenses precede grant reimbursements, Propel’s support has been invaluable. This latest loan is not just about managing cash flow; it’s about ensuring that every service we provide continues uninterrupted no matter when a grant payment is made or pledge fulfilled. Today, Propel is helping to ensure that Family Tree Clinic can reach over 20,000 people each year.

Propel has been alongside us on our journey for many years, helping us meet significant milestones together, from navigating transitions to fueling growth. Just a few years ago, when we embarked on the significant task of building a new clinic building, Propel stood by us, providing working capital that smoothed the journey.

We are so grateful for Propel’s steadfast partnership, and for all they do for our Twin Cities nonprofit community.

Read more stories about capital access here

Media Inquiries

Media inquires can be directed to:

Andrea Sanow, Senior Marketing & Communications Manager