What is Fiscal Sponosrship

Fiscal sponsorship is a common means by which an organization can accept tax-deductible donations without having its own 501(c)(3) tax-exempt status. It can be a great short- or long-term alternative structure while you are considering or preparing to launch as a 501(c)(3).

Fiscal sponsorship describes a relationship between an established 501(c)(3) organization (the sponsor) and a project without 501(c)(3) status whose charitable purpose aligns with the sponsor’s mission and vision. Typically, a group has come together with an idea for a project or program that will positively impact the community and they are ready to start testing it out. If the project wants to receive tax-deductible donations from grantmakers or individuals, under fiscal sponsorship they can solicit these tax-deductible donations to be given to the sponsor for the project’s purposes.

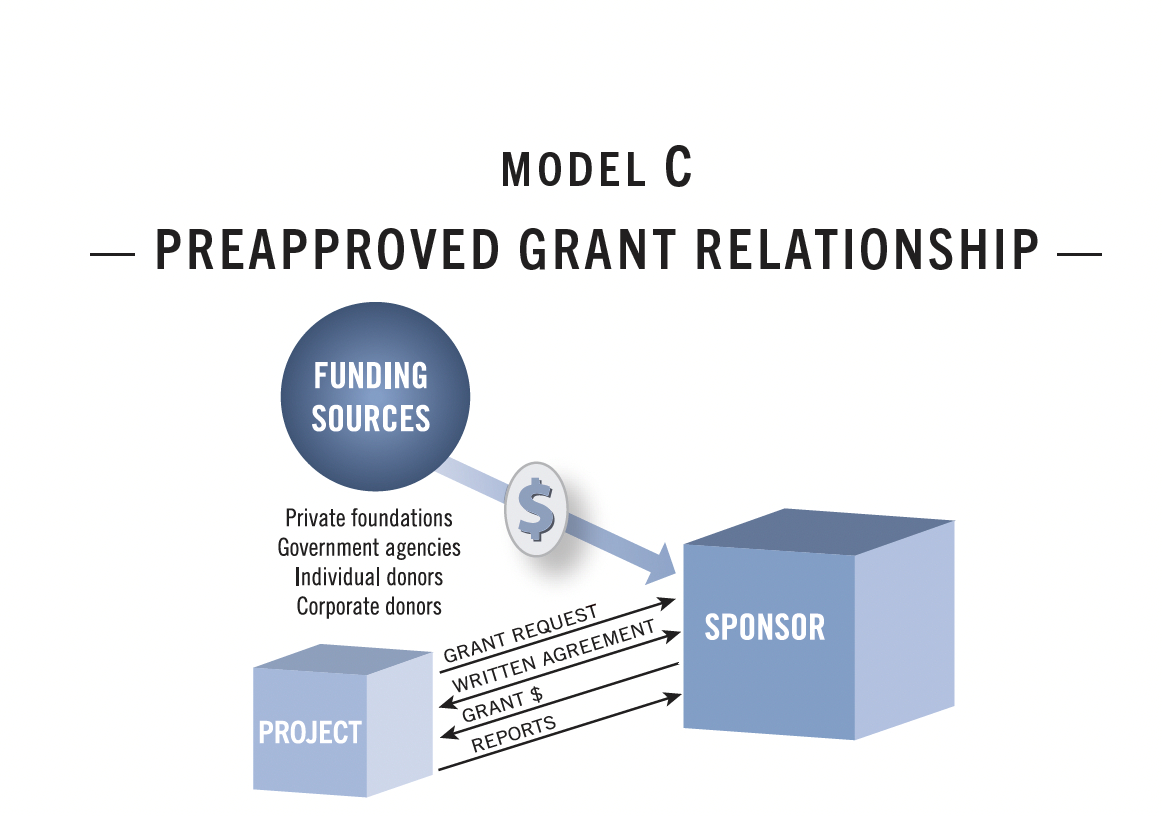

Propel exclusively offers a “Model C” type of fiscal sponsorship. In this model, sponsored projects are a separate legal entity from Propel. The project runs its own programs and operations, and can solicit grants and other tax-deductible donations to be given to Propel for the charitable purpose of the project. Propel then “re-grants” those funds to the project to be used toward meeting your mission.

When Should I Consider Fiscal Sponsorship?

You or your group might consider fiscal sponsorship to realize your charitable objectives if you:

- Want to establish a strong foundation before making a long-term investment and starting a 501(c)(3);

- Have applied for your 501(c)(3) status but want to start raising funds for your cause now; or

- Are a collaboration looking for a neutral host or are a time-defined project.

Propel Nonprofits fiscal sponsorship program is no longer accepting applications. You can learn more about this and find potential fiscal sponsors here.