True Program Costs: Program Budget and Allocation Template and Resource

This guide and accompanying spreadsheet template break down the process of understanding true program costs, either through budgeting or financial reports, into several stages.

While the long-term goal for nonprofits is not to return profits to shareholders, we all know that nonprofits are business entities that need to maintain financial health and stability in order to achieve their mission. Understanding the true, full cost of delivering various programs and services in the community is a critical piece of the management puzzle.

Why Does This Matter?

Equipped with accurate information about the cost of each program area, nonprofit leaders are better able to plan and manage budgets and make the case for support and for contract terms that cover the full cost of services. One of the most valuable results of understanding the true cost of programs is the ability to make wise choices about how to support mission critical work. For most nonprofits, some programs may be financially self-sustaining or even generate a surplus. Other activities may require periodic or ongoing subsidy from fundraising or other program areas. Deciding whether and how to support these services is a central strategic decision for nonprofits. Knowing the real costs of each program allows us to make informed decisions and choices that will lead to mission and financial success.

Propel Nonprofits Program Budget and Allocation Template and Resource

Propel Nonprofits developed this guide and spreadsheet template to help nonprofits implement program-based budgeting and financial reporting. This resource is an overview of the concepts and management decisions needed to calculate the true costs of activities for a nonprofit and also a how-to guide for the accompanying spreadsheet template. You can find a glossary of terms in our resource library and below, a list of articles and resources for more in-depth discussion or technical guidance on this topic. The accompanying spreadsheet template may be used for a one-time analysis project or to implement ongoing program-based budgeting and financial management practices. While a calculation can be completed for a single program or activity, we highly recommend that these concepts and practices be used throughout a nonprofit. Program-based financial information will be most useful for planning, management, and communications if it is comprehensive, accurate, and used consistently.

Getting Started

Before diving into the numbers and spreadsheets, it’s important to begin with a discussion about why the organization is undertaking this process, any specific goals you have, how the financial information will be used, and who will be involved in developing and using the information. If the organization has never allocated costs or overhead before, spend some time discussing the concepts and practices described in this guide. Having a shared understanding and buy-in from senior leaders, financial staff, and program managers is critical to both creating the budget and to using the information for planning and strategic decisions.

Gather the Data

Developing accurate program budgets and allocation formulas requires a number of data sources. Assemble as much as you can in advance, though it’s likely that more questions will come up once the process is underway. Some of the information will be specific to your organization, but as a first step you’ll need: a list of income and expense categories, detailed budgets, a list of staff, their compensation, and records or estimates of their activities, and information about major expense items, such as facility and program expenses.

Overview of the Process

- Define your programs

- Establish format and structure for accounting

- Identify direct and indirect costs

- Select allocation approach and methods

- Allocate staff salaries, benefits, and taxes

- Assign direct expenses

- Allocate direct costs by an appropriate method

- Identify program specific and general income categories

- Allocate indirect (administrative) costs

- Allocate fundraising costs

- Bring it all together for review

1. Define your programs.

The process begins with the decision of which activities at your organization comprise a program for the purpose of budgets and financial reports. Often, the definition of programs is evident in how your organization delivers services and functions internally. You may already have clearly defined programs, departments, or projects. Some nonprofits identify every activity or grant as a separate program while others combine many activities under the umbrella term. For budgeting and allocations we suggest that you separate your activities into distinct programs that will provide meaningful insight into the financial model. At the same time, avoid making it overly detailed or complicated. As an example, an afterschool program may operate in two locations or be funded by three grants. If the program operates with similar goals, measures, costs, and staff, we’d suggest that these be grouped as a single program.

2. Establish format and structure for accounting

Calculating and analyzing the true cost of programs and activities can be completed as a one-time project or implemented as an ongoing management practice, as we recommend. If that is the goal, it’s worthwhile to make sure that the program and cost definitions match the setup of your accounting system. Any accounting software can be used to maintain program-based financials, but they each have their own structure and terminology. One benefit of structuring accounting this way is that you can control your chart of accounts – the list of income and expense categories. Nonprofits that create new line items in their accounting system every time they start a new program or get a new grant will find that they can simplify their accounting by using program “cost centers.” Whichever system you use, make use of “cost centers” for the programs you defined and for management & general (administration) and for fundraising. These two cost centers are important components of understanding true costs and are created in parallel with the programs. By organizing your budget and allocations this way, you’re also setting up the accounting system to track and report the three functional expense categories required on audits and the IRS Form 990.

3. Identify direct and indirect costs

The terms direct and indirect costs are used with widely varying definitions in the accounting world. For our purposes, we define indirect costs as those expenses that support the overall management of the organization – often called administrative costs or management and general costs. Indirect expenses include the costs of accounting, board meetings, general liability insurance, and other costs associated with running the organization as a whole. This distinction has been problematic for many nonprofits because of the simplistic idea that common costs such as rent, utilities, and technology are all indirect costs, or overhead. The accurate definition for direct costs is those costs that are required to carry out a program or function. Direct costs may be devoted to one program but more often are shared by more than one program. Rent, for example, is a direct cost for all programs that make use of the facility to plan, manage, and deliver the program services based on how much of the space they use. The portion of rent that is for space used for general administration is categorized as indirect. Fundraising may also have direct costs or receive an allocated portion of a direct cost, as will be explained later. Sometimes direct costs will be allocated to all program areas and cost centers, including fundraising and administration. We will discuss the allocation of both direct and indirect costs later in the process. This step asks you to take a fresh look at the list of expenses and identify all of the direct and indirect costs.

4. Select allocation approach and methods

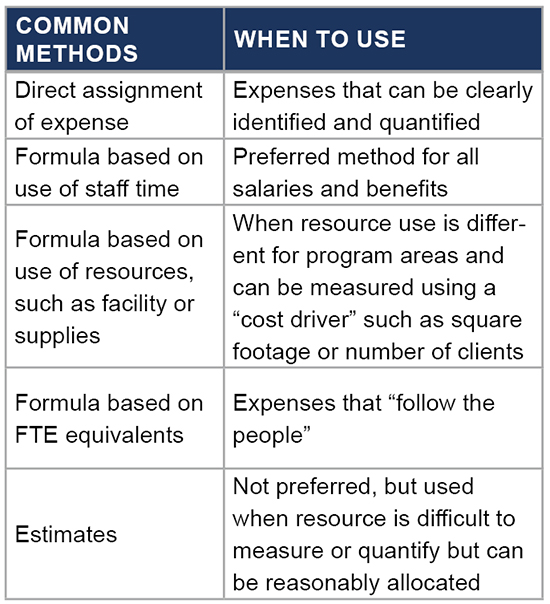

Once you’ve defined which expense items are direct program costs that are shared by more than one program, you also need to decide how to allocate the cost appropriately. The best allocation methods are reasonable and justifiable while also being simple enough to calculate and maintain over time. An example would be the cost of office supplies that are used by all of our programs and by fundraising and administration. Rather than counting every pen we look for a reasonable basis on which to share the expense proportionally. For our office supplies example, we’ll allocate the expense based on the number of staff members who work in each program, calculated based on FTE. This is a practical method for expenses that “follow the people.” The most common allocation methods are: FTE or staff time, square footage, number of clients, “units” of services, and percentage of total direct costs. Other methods may also be appropriate and useful if there is a reasonable connection between the method and the actual use of the resources or expense. The basis of the calculation is sometimes called a “cost driver.” In order to keep the allocation system manageable we recommend that you create and maintain just a few allocation choices. The chart on the next page can help you select allocation methods.

5. Allocate staff salaries, benefits, and taxes

Given the significance of personnel expenses to our finances, allocating these costs is essential to understanding true costs. How does each member of the staff spend their time? Job title doesn’t necessarily provide the answer. If the Program Director spends 50% of his or her time managing Program A, 30% supervising the managers of Program B, and 20% acting as the organization’s HR director, then 80% of the cost of salary and related benefits will be allocated between the programs and 20% will be included in administrative, or indirect costs. Many Executive Directors spend a substantial amount of time working directly in programs. Ideally, salary allocations will be based on regular, reliable tracking of time. The data is already available for nonprofits that track time for grants and contracts. If that has not been your practice we urge you to gather some accurate information by completing a timekeeping report or adding time reporting to payroll or database records. We know from experience that allocating time based on general estimates or gut feeling is often inaccurate. The goal of program-based budgets and allocations is to gain a solid understanding of the true costs, and staff cost is too important to leave to guesswork.

6. Assign direct expenses

When an expense is clearly and exclusively incurred for a specific program area or cost center, we simply assign the expense to that program area or cost center. Examples might include materials purchased specifically for a tutoring program or the cost of an evaluation consultant to document the results of a preschool program. Administration and fundraising may have direct expenses assigned to them as well. The cost of an annual audit would be assigned to administration. The cost of return envelopes to be included in a fundraising mailing would be assigned directly to fundraising.

7. Allocate direct costs by an appropriate method

In this step you apply the allocation methods described above to the various direct costs that are shared between programs, which may include administration and fundraising cost centers. For the earlier office supply example, you would add up how many FTEs work in each program area and calculate a formula as a percent of the total number of staff. These calculations may be automated through the accounting system or completed manually. The formulas should be revisited if there are major changes in the way expenses are used, such as staff reassignments or growth of a program. For many organizations the formulas don’t change more than annually. At this point you will have a subtotal of the direct costs of each program, administration, and fundraising. The process doesn’t end there, though.

8. Identify program specific and general income categories

This process is most valuable when a nonprofit can understand both the full cost of delivering programs and the amount and type of income that relates to those programs. Leaders can use this information to analyze the financial model of programs individually and as part of the whole. In this step you will identify which income items are connected to specific program areas and what income can be directed at the organization’s discretion. Examples of income that is assigned directly to a program include contract or fee income for a preschool program or a grant that is received for a tutoring program. For this step we recommend that contributed income that is unrestricted or general operating support be assigned to the fundraising category for the analysis. The final analysis will clearly show what program areas require these sources of support and enable leaders to make the all-important decision about how to best attract and direct flexible funds.

9. Allocate indirect (administrative) costs

The cost of administration, categorized as indirect costs, adds value to every program at a nonprofit. Programs are more effective, better managed, and more responsive to the community when an organization has good accounting and technology, high quality leadership, planning, and governance. In order to have a true picture of what our programs really cost, we must allocate these indirect or administrative costs as well. If we ignore this step, we will be underrepresenting the expense involved in supporting each program area. As explained above, indirect expenses are generally all of our administrative expenses – those expenses that support the overall management of the organization. Some expenses are assigned to the indirect category specifically, such as the audit. Others are allocated to the indirect category, such as a portion of rent and telephone. For this reason we wait until after all the direct allocations are completed before we turn to allocating the indirect costs. The two most common methods for allocating indirect costs to programs are percentage of total direct costs and percentage of FTE.

10. Allocate fundraising costs

Similarly, the cost of fundraising is valuable to programs and the final step is to allocate fundraising expenses to each. The most common basis for allocating fundraising costs is based on percentage of total support received by each program. This method matches the percentage of fundraising expense charged to a program to the percentage of contributed income that program receives. We leave this step until last because some funders, including many government funders, will not allow fundraising expenses to be charged to their grants or contracts. Regardless of whether a funder will pay for fundraising expense, it remains part of the total cost of running each program and we need this information to be truly informed. The same is true for allocating administrative/indirect costs.

11. Bring it all together for review

After completing the full program-based budget or financial analysis it’s worthwhile to take a fresh look for both accuracy and a gut check. Do the formulas, amounts, and financial results match what you expected, or do they surprise you? If there are surprises, first review the data to verify the calculations and choices about allocations and definitions. Sometimes, though, the surprise comes from seeing the true and full costs for the first time. The benefit is that you now have better information for discussions about priorities and how resources are used. With this information your organization is better equipped to review costs, prices, and contract terms; communicate gaps and fundraising priorities; and discuss which programs require financial support and how that relates to accomplishing your mission goals.

Allocation Methods

Additional Resources and Links

This overview and guide to using the Program Budget and Allocation Template is not intended to be a definitive or comprehensive document for such a complex financial management practice. We hope that you will be able to use this resource to understand the concepts and steps and to implement this valuable process at your nonprofit.

From Propel Nonprofits:

From other sources:

- Real Talk About Real Costs video, Forefront

- Costs are Cool: The Strategic Value of Economic Clarity, The Bridgespan Group

- Nonprofit Cost Analysis: Introduction, The Bridgespan Group

- Book: The Sustainability Mindset by Jeanne Bell and Steve Zimmerman

Copyright © 2024 Propel Nonprofits